Elevating Commercial Valuation Methods

Just Appraised

Duration: 2023

Role: UX Research, Product Design

Introduction

In the world of property appraisal, residential property appraisal sits alongside its less known sibling: commercial property appraisal. Commercial property appraisal is inherently more challenging than residential, as properties exist with fewer shared characteristics between them and appraisers have to often rely on external sources in order to provide accurate valuations. Furthermore, as the volume of property tax appeals within a county usually favors the residential side, counties are less equipped with tools that provide easy ways to manage and organize commercial appeal data. While residential property appraisal might, from a volume perspective, have more accounts within a county, commercial properties are ultimately where the county receives the larger majority of its taxes. Ultimately, commercial valuation is intrinsically more complicated than residential valuation and though this process we were able to identify and design a tool to alleviate a number of the challenges facing commercial appraisers today.

UX Challenges

When first trying to understand the challenges and needs of an assessor sitting within the commercial valuation space, we met with over a dozen both existing and prospective customers to discuss and better identify the pain points presented in their day-to-day role in the commercial space. Immediately we were met with a number of different issues in the space, ranging from challenges getting income and expense data (to provide an accurate understanding of a cap rate—ratio—of income to sale price) to challenges managing the appeals process (dealing with owner provided income and expense data, preparing the appeals packet, and coordinating the various hearings).

Assessors often used a number of different sources and platforms in order to input, categorize, and aggregate data, and that was even before they started their valuation and analysis process. At that point, assessors were often forced to manage and manipulate large spreadsheets providing the necessary macros and calculations used to determine proper valuation methods.

User Research

After utilizing a few of our first meetings to initially gauge and understand the space, we put together a handful of early designs that incorporated some of the elements appraisers spoke frequently about as a means of further understanding their challenges and identifying areas that sparked greater interest.

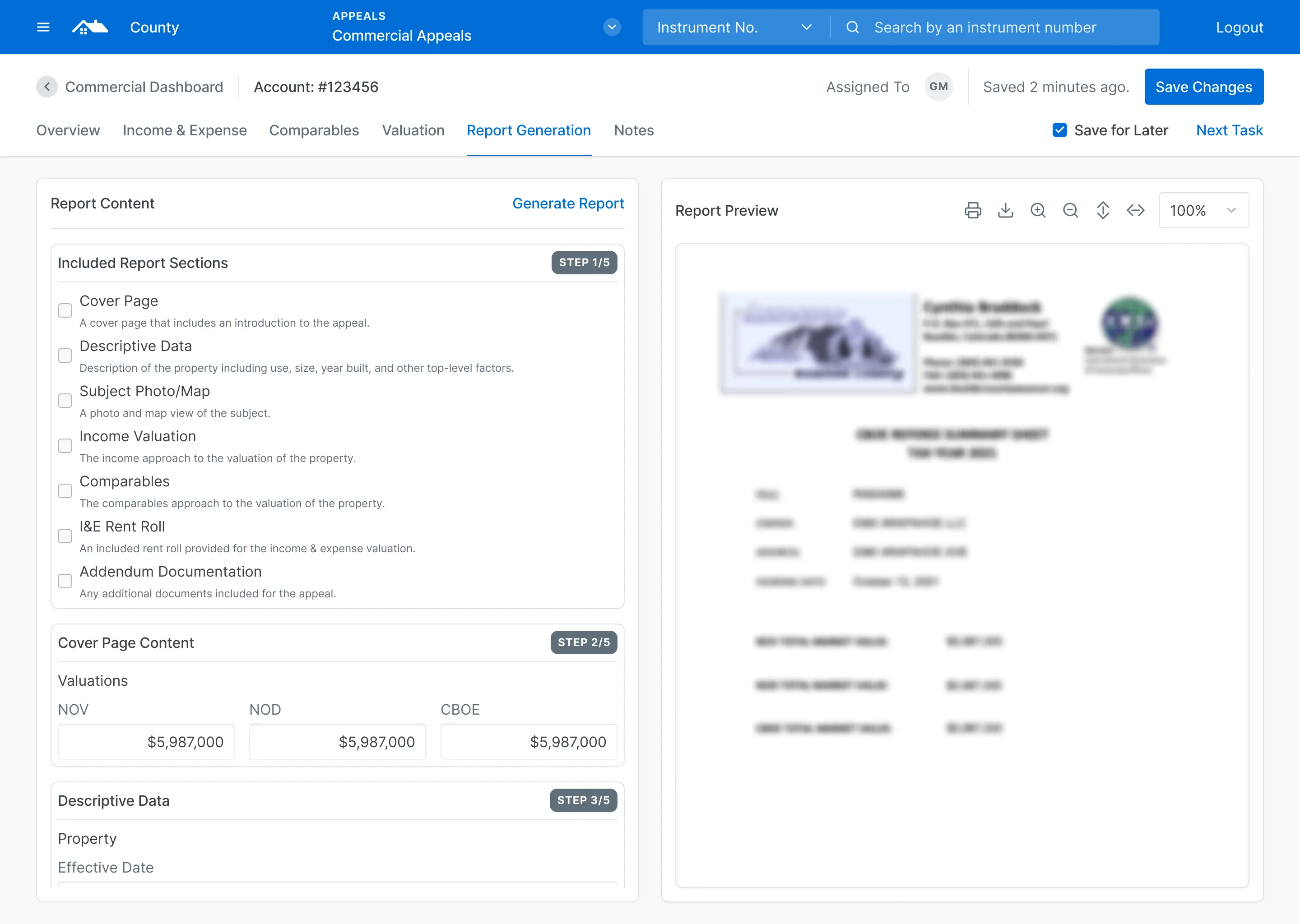

By utilizing these meetings in this way, we could make frequent and timely updates to tweak designs in directions that further resonated with customers. Later during our research period, we shifted focus towards a more complete prototype that identified two distinct, time-consuming scenarios for assessors: income and expense data intake and analysis as well as appeals preparation and management. By identifying these two challenges, we were able to better tailor and present designs to customers that reflected a consensus of description of their challenges. Furthermore, we were able to dig deeper and identify prerequisites and locations that needed additional attention during the research process.

Design Approach

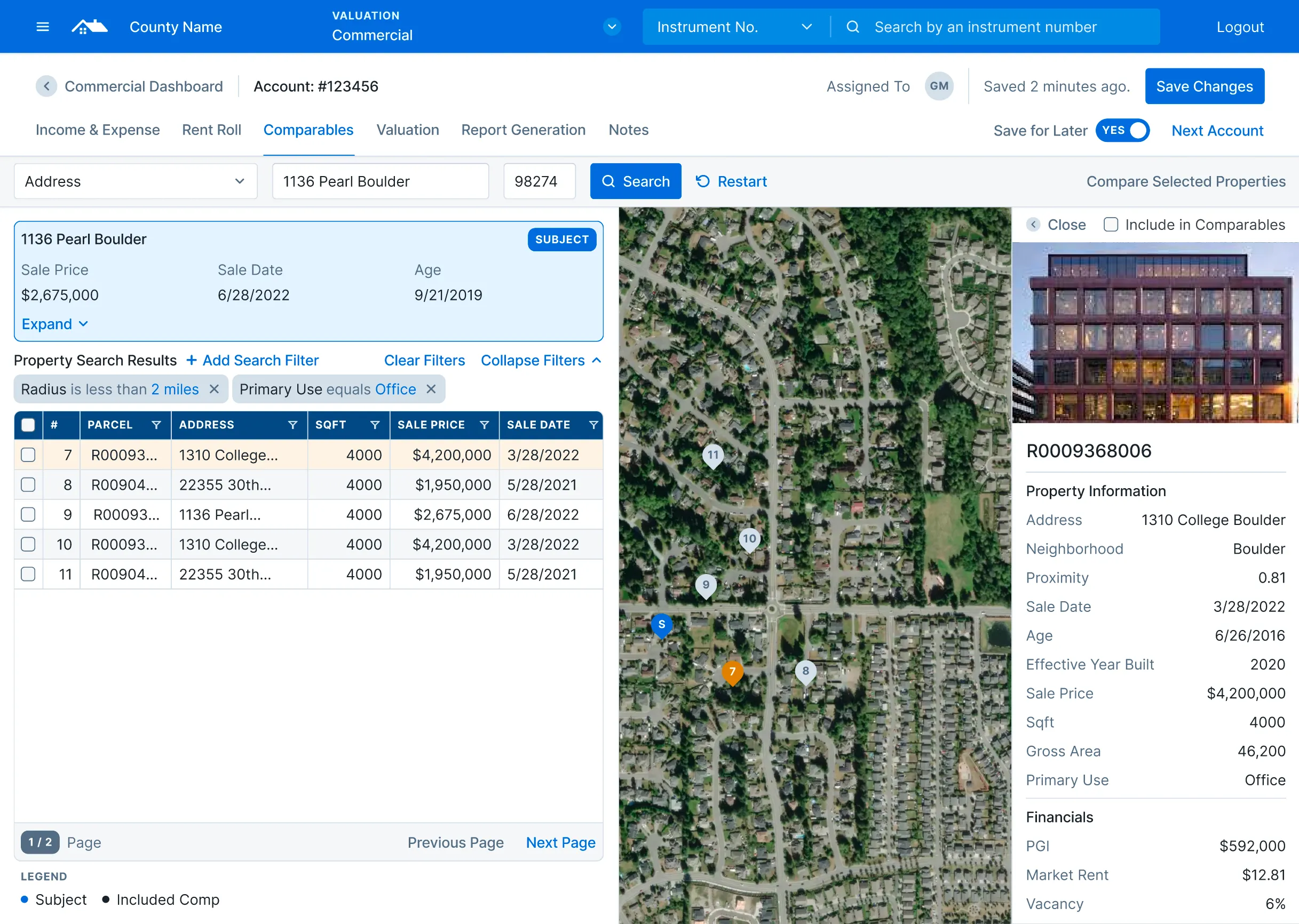

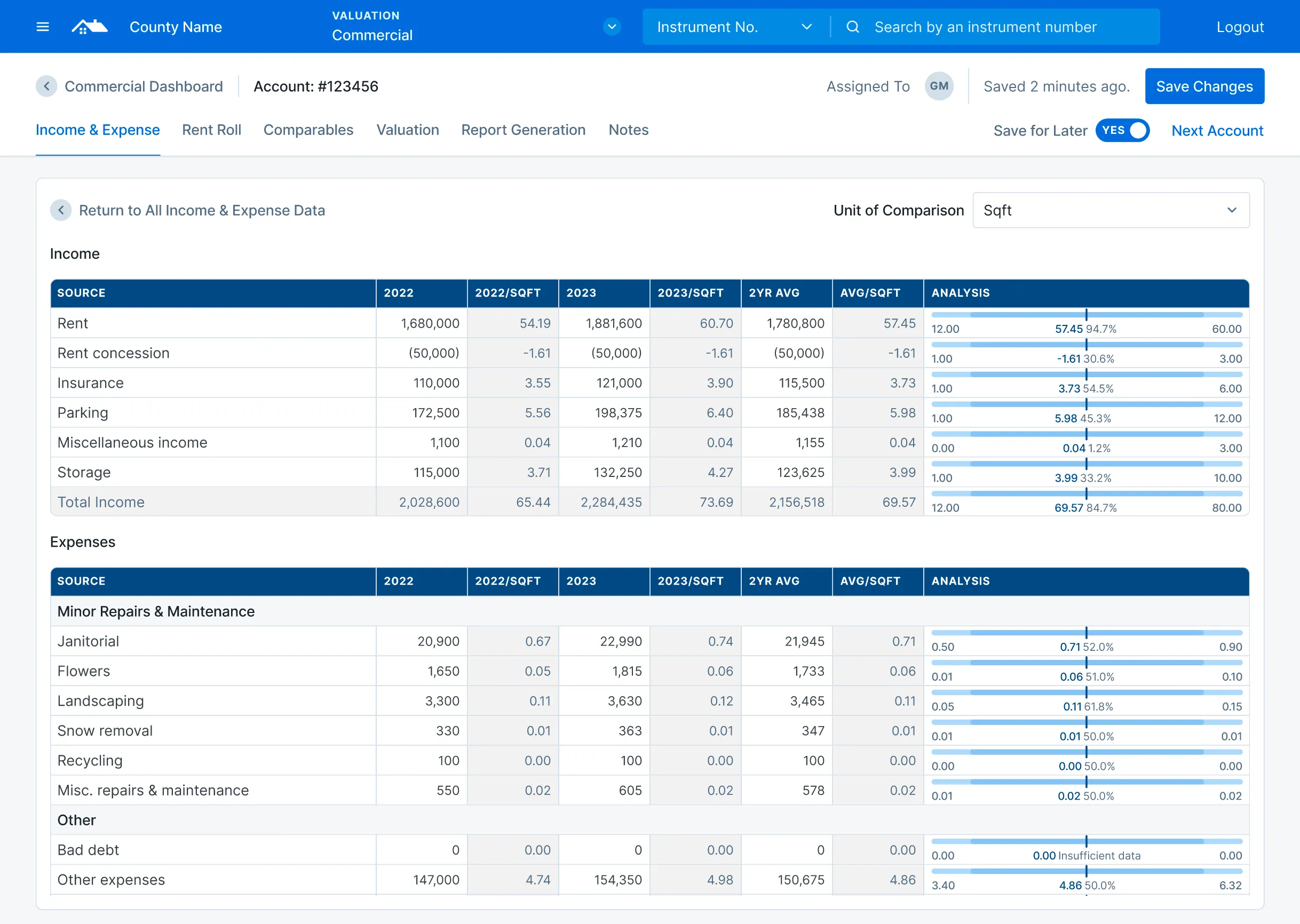

To break out of the classic, linear-style workflow that Just Appraised traditionally supports and instead support an experience that allows assessors to efficiently provide data-intake methods for reviewing and inputting income and expense data as well as compile and prepare appeal evidence, we transitioned the interface to one that favored the jumping back-and-forth nature of processing this type of data.

In addition to favoring a tab-based approach for showcasing and organizing data, we also wanted to provide assessors with real, analytic-based data on a line item basis to help them understand how the taxpayer-provided values relate to the larger dataset values as whole. This gives assessors with less familiarity to data trends the ability to extrapolate trending values for specific attributes on a property (income per square foot, expenses per square foot, gross income multipliers, etc), ultimately better informing their decisions on providing accurate valuations for their properties.

Outcomes

Ultimately, while the project is still ongoing, we have been able to accomplish a large amount over the last few months, having gone from understanding little about valuation, let alone the commercial valuation, to flushing out fully-functioning prototypes that we have been able to use to validate and understand customer needs, as well as begin the sales process with counties for delivering upon this as a functioning software. The project has been an amazing learning process, providing countless opportunities for validating user research with customers as well as rapidly iterating and changing requirements with customer needs in mind.