Easing Value Transfer for California Residents

Just Appraised

Duration: 2022

Role: UX Research, Product Design

Introduction

California provides its constituents with the ability to transfer a base-year value from a previous residence to a new residence, allowing them to utilize a potentially lower assessed value when moving to or replacing their previous residence. Because this law was only introduced in 2021, many counties are ill-equipped with mechanisms that allow them to process and manage these value transfers. Furthermore, because this law was passed at the state level, all counties within California are facing this issue and are likely interested in potential solution conversations.

UX Challenges

California placed this into law in 2021 through its passed Proposition 19 law, so counties have had little time to put in place systems that can handle constituents filing these forms. Currently, the California Board of Equalization provides a number of different forms that allow taxpayers to apply for a base-value transfer depending on the qualification or requirement met. Furthermore, forms are often packaged together into a grouping (as some forms exist as prerequisite for others), so the management and organization of ensuring all forms and data exists can be a challenge.

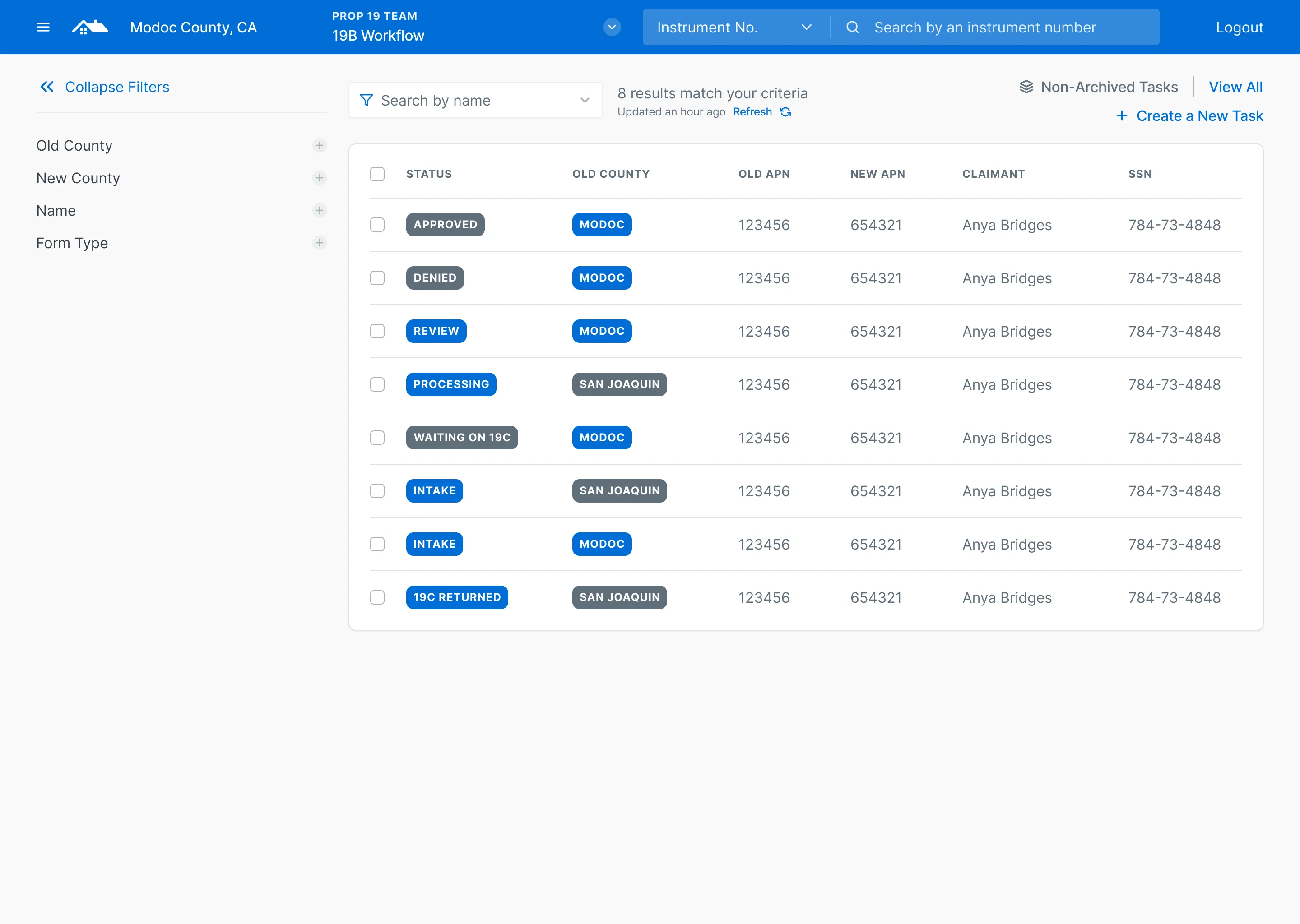

In addition to managing and organizing the different forms required for the base-value transfer, counties often need to correspond with other counties in order to certify the validity of the transfer. In order to do this, counties will send the previous county (the one the taxpayer is transferring from) a request for a verification that the taxpayer lived in an owned the previous property stated. This further complicates the flow, as now tasks often have to shift hands between counties, making the experience of knowing where a task exists within the workflow a principal concern.

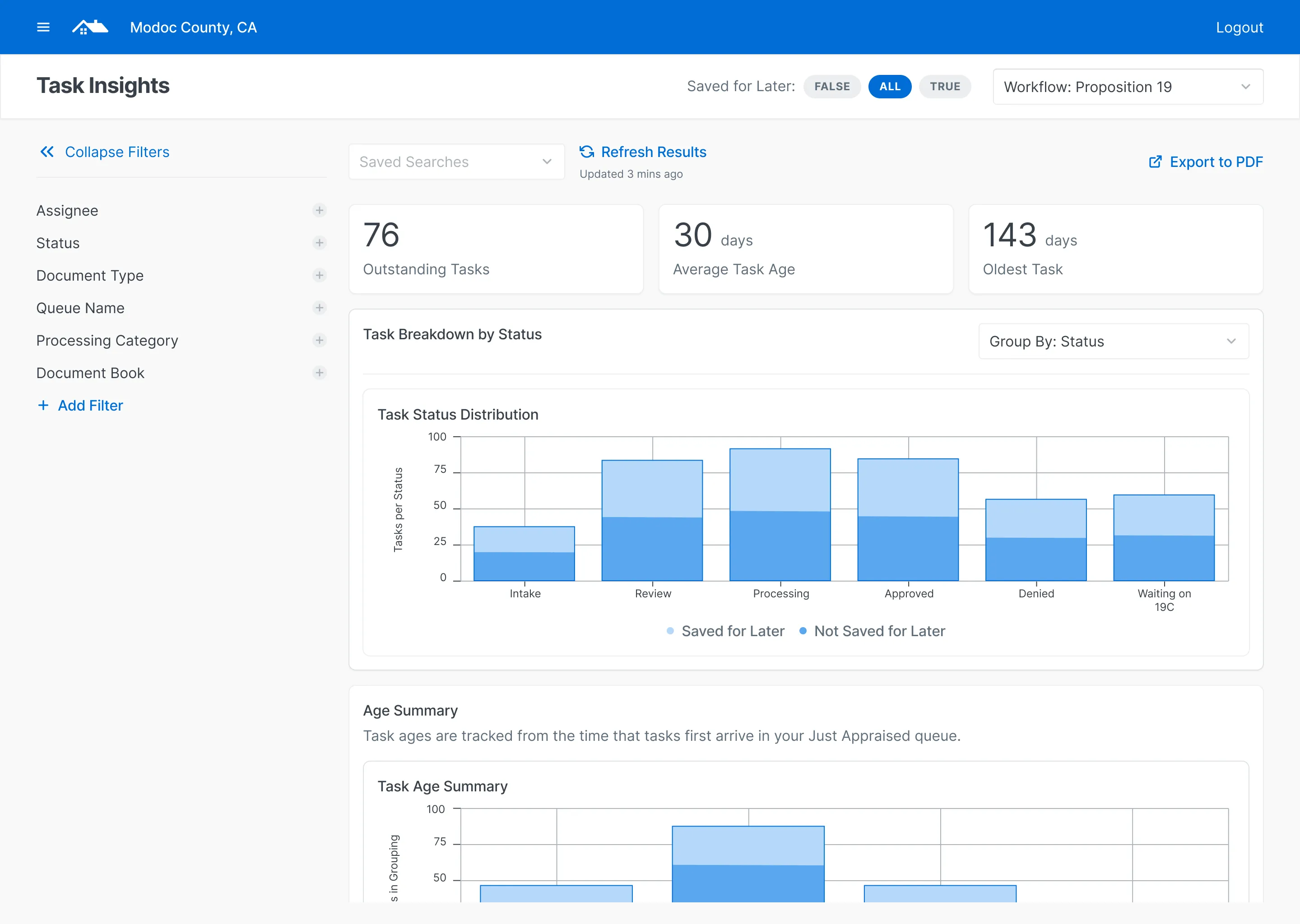

User Research

After putting together initial versions of designs, we went ahead and began testing designs with a few existing customers utilizing the Just Appraised deeds product within California. They were all versed in the recent passed proposition and some were eager looking for potential solutions within the space. Furthermore, the State of California had set aside $30 million in discretionary spending for counties across the state to utilize for implementing different technology solutions to address Prop 19 and other recent state initiatives. This focused our research through the lens of offering a one-stop solution for counties across the state to manage Prop 19 related inquiries from taxpayer and to redirect their inquiries to other counties on the platform when required.

Design Approach

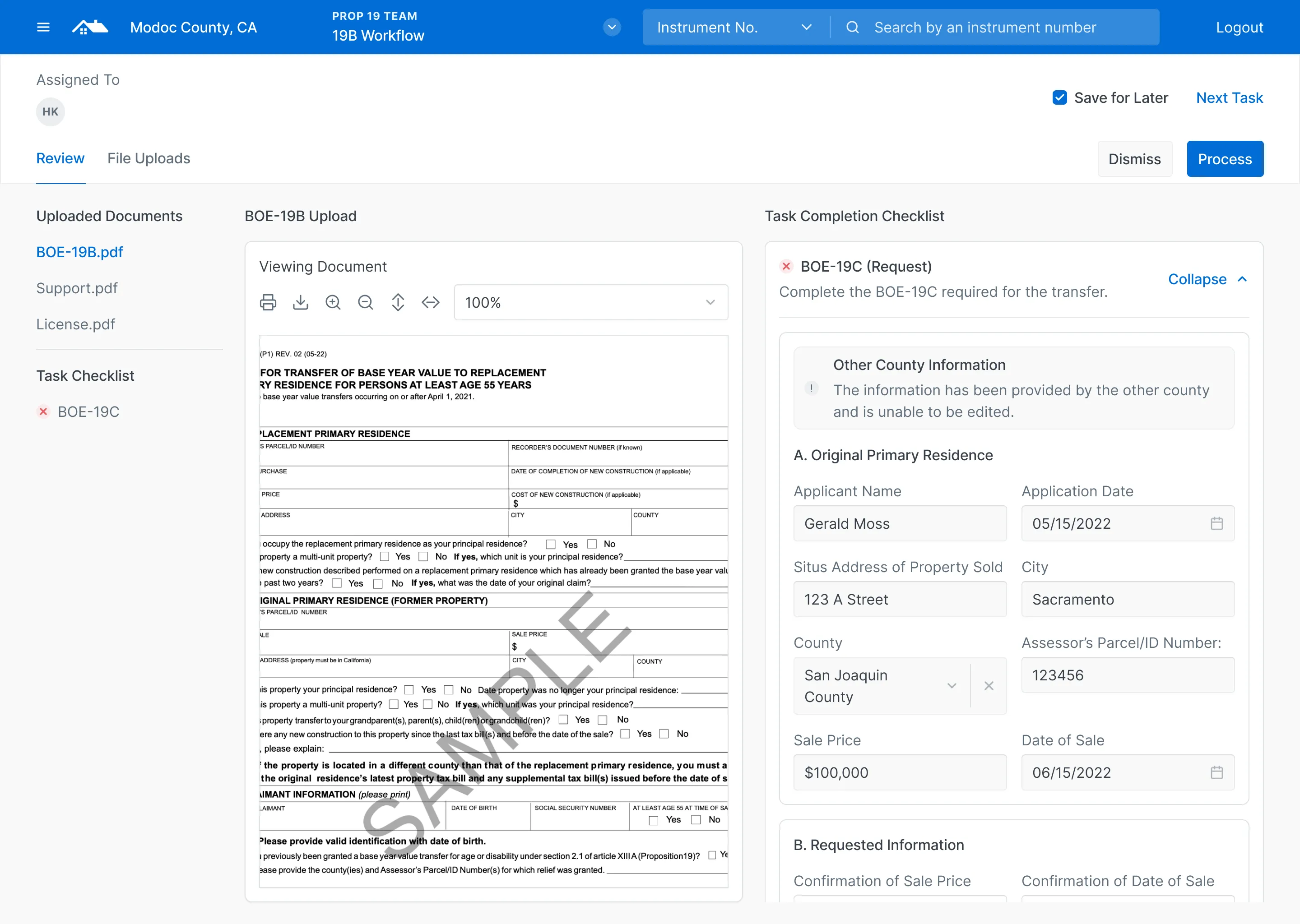

To break away from the traditional, linear approach of the Just Appraised product workflows, we decided to utilize a checklist-based approach for representing the workflow of organizing, requirement checking, and processing of the forms within the Prop 19 packet. Typically, forms may come in at various times and it’s often likely that a taxpayer might need to submit an additional form or document after further evidence is requested, so it became paramount that we treat the experience as a checklist rather than a linear flow where customers might end up stuck.

Considering the nuance where counties may pass forms between themselves during the review process, designing a flow that supported rendering clear status indications, especially when the task was within a different county’s context, was important for the visibility of processing these requests. By providing the context of where a task was within the process, counties had a greater degree of accountability and ownership for returning requests to the requesting county on time.

Outcomes

This project provided me with great exposure into the complex nature of tax law, especially in regards to the transfer of value, where there are often complicated nuances that can be overlooked easily. Once we were able to identify and understand the process of managing, processing, and applying these transfers for a county’s constituents, I was ultimately able to design an experience that provided a focused user flow with an intuitive, checklist-based approach. Given the complex nature of the ownership of the task changing multiple hands (and counties), this design approach provided a more guided experience through the processing these transfers, something that would not have been achievable with the existing, linear Just Appraised workflow.